Difference Between Online and Offline Two-wheeler Loans

Understanding the Key Differences in Applying for Two-Wheeler Loans Online vs. Offline

Getting a two-wheeler in India often requires financial help, and loans play a significant role in making it affordable. But, when it comes to choosing between online and offline two-wheeler loans, many borrowers find themselves at a crossroads.

Each option comes with its own set of features, benefits, and drawbacks. Understanding these differences can help you make an informed decision based on your needs and convenience.

What Are Online Two-wheeler Loans?

Online two-wheeler loans refer to loan applications and approvals processed entirely through digital platforms. You can apply for these loans via a lender’s website, financial marketplaces, or mobile applications. This method has gained popularity due to its speed and simplicity.

Key Features of Online Two-wheeler Loans

Digital Application Process

You can complete the entire loan process from application to disbursement online

Quick Processing Time

Online loans often come with instant approval and faster disbursement

Convenience

You can apply from anywhere without visiting a branch

Transparency

Loan details such as the bike loan interest rate, tenure, and EMI are clearly displayed before applying

Access to Multiple Lenders

Financial marketplaces offer comparisons of loans from different lenders in one place

What Are Offline Two-wheeler Loans?

Offline two-wheeler loans are obtained by visiting a bank or financial institution in person. You can also get these loans directly from authorised dealerships that have tie-ups with lenders. This traditional method is preferred by those who value face-to-face interactions.

Key Features of Offline Two-wheeler Loans

In-person Assistance

Bank representatives or loan agents guide you through the application process

Document Verification

Physical submission and verification of documents take place

Customised Offers

Some lenders may offer special deals based on personal relationships or loyalty

Negotiation Possibility

You might negotiate better terms, such as a lower bike loan interest rate

Personalised Service

Customers can directly address queries and concerns with a representative

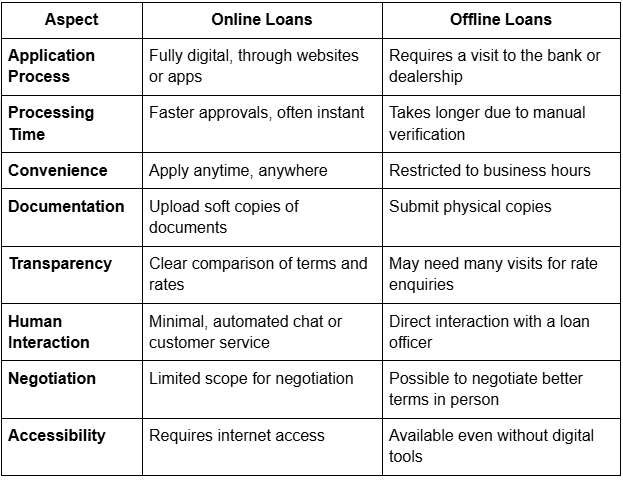

Differences Between Online and Offline Two-wheeler Loans

Let’s break down the key differences between these two methods:

Which Option Should You Choose?

The choice between online and offline two-wheeler loans depends on your personal preferences and circumstances.

Choose Online Loans If:

You prefer a quick and hassle-free process

Comparing loan offers is a priority

You are comfortable using digital tools

Choose Offline Loans If:

You value face-to-face interactions

You want to negotiate loan terms in person

You need personalised guidance through the process

Factors to Consider Before Applying

Interest Rates

Whether online or offline, compare the bike loan interest rate offered by different lenders. Even a small difference can impact your overall repayment.

Loan Tenure and EMI

Ensure the tenure and EMI fit your financial situation. Use online calculators to plan better.

Processing Fees and Charges

Look for hidden charges that could increase the cost of borrowing

Loan Eligibility

Check the eligibility criteria, including income, employment type, and credit score, for both loan types

How to Apply for a Two-wheeler Loan

Online Application Steps

Visit the lender’s website or a financial marketplace

Fill in the application form with your personal and financial details

Upload the required documents

Review the loan offer, including the interest rate and tenure

Submit the application and wait for approval

Offline Application Steps

Visit the nearest branch of your preferred bank or a dealership with loan tie-ups

Discuss loan options with the representative

Fill in the application form and submit physical documents

Wait for manual verification and approval

Once approved, complete the formalities and disbursement process

Also Read: Mistakes To Avoid While Choosing a Two-wheeler Loan In 2024

Conclusion

Understanding the differences between online and offline two-wheeler loans helps you choose a loan that fits your needs. While online loans offer speed and convenience, offline loans provide a personalised experience. Check your priorities, compare offers, and make an informed decision.